Review of Pemex’s Strategic Plan 2025–2035

1) Financial self-sufficiency by 2027

• The Mexican government issued ~$12 billion USD in pre-capitalized bonds to cover Pemex’s debt obligations due in 2025 and 2026. These P-Caps are backed by U.S. Treasuries. If Pemex defaults, the Treasuries would be liquidated to compensate P-Caps investors, who would otherwise be left holding Mexican sovereign debt.

• In addition, the Ministry of Finance established a ~$13 billion USD trust—funded ~50% by national development banks and 50% by commercial banks and private investors—dedicated exclusively to financing Pemex’s projects and ensuring guaranteed payment to all suppliers and contractors engaged with Pemex in 2025.

• The Mexican Finance Minister expects Pemex’s debt to fall, from $99 to $89bn by end-2025 and to $77bn by 2030 (a 22% reduction).

2) Exploration and Production

• A total of USD 86 billion is planned for investment between 2026 and 2030 in exploration and development activities, with the objective of achieving a production target of 1.8 MMbpd of oil and condensates. The projected Capex allocation by contract type is as follows:

Pemex will focus its capital allocation on four main areas: maximizing output from existing fields (Base), developing new fields such as Chamak, Nikita & Xomili, and reactivating mature wells through service contracts (Incremental), advancing strategic PSC and license agreement projects such as Zama, Trion & Bacab (Contracts), and launching the new Mixed Contracts, targeting high-potential assets such as Ixachi.

• Under the Mixed Contracts model, more than 21 greenfield and brownfield projects—covering both oil and gas assets across onshore, shallow-water, and deepwater Figures in billion pesos areas—are expected to be developed by private operators in partnership with Pemex reaching a peak production of 450 thousand bod in 2033:

• Mixed Contracts are expected to produce 714 MMcfd by 2030.

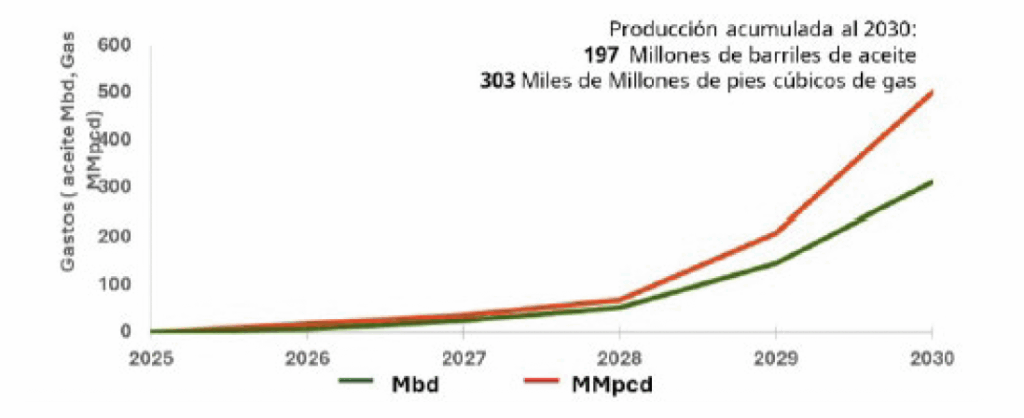

• In addition, the development of unconventional oil and gas fields by private operators is projected to contribute the following annual production volumes:

3) Midstream & Downstream

• Two new Coker plants at Tula and Salina Cruz refineries to improve efficiency and reduce fuel oil production.

• Increase in fertilizer output: o 1.1 MTA of phosphates and 1.6 MTA of urea.

• Three natural gas pipelines to meet Southern Mexico’s demands: Interoceánico, Conexión Maya and Coatzacoalcos II.

4) Electricity Generation and Transition

• Sell electricity to the open market from cogeneration plants to be developed in Tula, Salina Cruz, Cangrejera, and Nuevo Pemex totaling 2.1 GW

• Pilot projects in hydrogen, geothermal energy, and energy efficiency and lithium-extraction projects.

• Reduce 25 MT CO2E emissions in 2030

Market Reactions and External Assessments

• Fitch upgraded Pemex’s rating from B+ to BB with a stable Rating Outlook, because of the completion of the P-Caps funding by the Ministry of Finance.

• Risk that financial relief by the Ministry of Finance could not be sustained if strong governance is not consolidated.

• Opportunity to advance toward a sustainable transition.

• Critical window to establish public–private partnerships with E&P operators and restore confidence in Pemex as a reliable counterparty, attract investment, and sustain production levels.

• Urgency to modernize internal processes and divest inefficient assets not clearly articulated in Strategic Plan.

New Electricity Generation Regulation

On August 7, 2025, the National Energy Commission published the new Regulation establishing the requirements for obtaining generation permits for self-supply electricity projects interconnected to the grid, with capacities between 0.7 and 20 megawatts (MW), in compliance with the Electric Sector Law (LESE). Key requirements include:

• Applicants must state whether they have secured their own or contracted energy backup for intermittent sources injected into the National Transmission Grid or General Distribution Grids.

• Legal names of all end-users connected to the private network linked to the generating facility must be disclosed in accordance with the Law’s Regulations and applicable General Administrative Provisions.

• If the project is not yet in operation, a general description of the financing plan and business plan must be included, along with construction timelines and projected commercial operation date.

Sources:

1) Pemex: Plan estratégico 2025 – 2035

2) Fitch Upgrades PEMEX’s Rating to BB, Removes Watch Positive; Outlook Stable

3) Acuerdo de la Comisión Nacional de Energía por el que se establecen los requisitos para obtener el permiso de generación para autoconsumo interconectado en centrales eléctricas cuya capacidad sea entre 0.7 y 20 megawatts (MW).